- Be Yourself Marketing

- Posts

- The "more money" myth ... [🐝U]

The "more money" myth ... [🐝U]

Let’s rip the band-aid off.

Money is a sensitive topic.

For a lot of us, it’s as loaded as religion or politics.

But lately, between client calls & this bank notification.

I realized it’s something we almost never talk about.

Not how much you make.

Or how much “more” you want.

But what you actually keep

& what it really costs to live your life.

A large expense?

On my business credit card?

I’ve had large expenses thanks to solar guy #1 scamming me & having to pay solar guy #2 to help out.

But those payments aren’t on the credit card.

That “large” expense was $100.

Large … not because it’s a lot,

but because I don’t have many business expenses.

Know my business (& life) doesn’t need a lot of money to run

Means I don’t need a massive income number to feel “safe”.

My business expenses are boringly simple:

Recurring: phone, Starlink

Annual: Canva, Microsoft 365

I cancelled Audible.

Not because I couldn’t afford it,

but because I wanted to stop adding more before I’d used what I already had.

That’s it.

The lie we’re sold about money

There are occasional one-off purchases.

But they’re so few & far in between that I get a “large expense” notification every time something comes up.

But it wasn’t always that way.

I got stuck in the same traps as everyone else.

& I thought the solution was to just “make more”

Most people chase higher income because it feels safer.

But what actually changes your life

is being in control of where your money goes.

It’s 1 of the main reasons we start a business

… more money

& having more money is supposed to give us the “freedom & flexibility” we long for.

Higher income ≠ more freedom

But the thing most of us don’t realize until payment plans dictate our lives.

It doesn’t matter how much money you make

Or even how you make it (job, business, winning the lottery, robbing a bank, etc)

(OK technically it does matter how you get money … at least from a legal /moral/ethical standpoint)

If you don’t know how to keep, protect, & grow money,

a higher income just means bigger pressures.

It’s never going to feel like it’s enough.

It’s paycheck to paycheck

Just with bigger & unpredictable numbers when you’re a business owner

In fact the bigger the amounts, the worse off you’ll be …

because you’re in deeper water with the weight of larger payments when that money runs out.

When income rises, so does “lifestyle”

I’ve seen the same pattern over & over…

spending sprints to catch income.

In 2016, a wildfire tore through Fort McMurray, Alberta

It’s an oil town with big paychecks & bigger spending.

People went there to “work a few years & save.”

Instead, as income rose, so did trucks, boats, cabins … all on payments they could “afford”.

When the work disappeared because of the fires, the payments didn’t.

& sure the provincial & federal governments fast-tracked the unemployment benefits

But that’s not going to cover all that non-essential nonsense.

Yes this is a crazy extreme

But this isn’t an oil town problem.

It’s a human behavior problem.

We’re taught how to spend, not how to keep

I’ve seen tenured professors earn over $250,000 after tax

& still can’t afford to set aside for their kid’s education.

Higher income doesn’t automatically create financial security.

Behavior does.

I remember starting college, all the major card companies were on campus.

Just because I was 18 & enrolled in post-secondary education, I pre-qualified for a card.

They encouraged you to use the balance to buy those crazy expensive textbooks,

Then all I had to do was make the minimum payment

… that would free up cash & build my credit rating.

WoW … talk about the win-win

NOT

I was lucky.

My parents taught me the difference between wants vs needs

& saving up to pay cash for both

But if there was something “needed” without time to save, how to take advantage of those “interest-free” periods.

These days (at least in Canada), the card statement shows how long it would take to pay off the balance (assuming you don’t add to it) with minimum payments.

But I still see people buying furniture, electronics, & “stuff” on credit then making payments.

A co-worker (from pre-freelancing days), put every “thing” in his house on a store card.

He was still paying for things years after replacing them.

Where’s all this money talk going?

This doesn’t just apply to money from “steady” …

This matters MORE as a business-owner

Business owners aren’t immune.

We just call it “investing in growth.”

& we can get sucked into a “learning loop” without ever earning.

Because we were never really taught how to use money or budget

Just how to spend it

& make payments

There’s no 1 solution to this.

Just like there’s no 1 “right” way to anything.

It depends.

Because we all have our own pre-conceived notions about money

→ From things we heard growing up

→ Our own experiences in budgeting

We love complaining about taxes & cost of living

In marketing, we know that people love to buy, but we hate being sold.

But we also hate to look at what it’s costing us.

For your business to succeed, you have to START with where your money is going.

Because income is only half the money story.

It’s your profit that actually builds freedom & flexibility.

& that profit comes from our spending decisions … not just sales numbers.

But those expenses you still have to pay for … cell phone, internet, utility bill, rent/mortgage

Those are consistent.

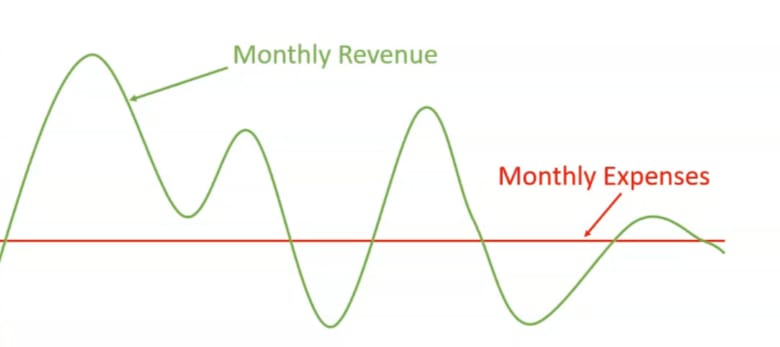

But your monthly income as a solopreneur is variable

If you’re living “paycheck to paycheck” with the steady income from a job

What happens when you lose that consistency?

Cue “feast or famine” mentality

If you don’t know your min, you forever chase the max

But what if you took some time to think about & understand money.

What if you knew (exactly) what survival actually costs you every month?

Not ultra-cushy comforts of the 1%.

Not lifestyle upgrades.

Just the bare minimum survival.

→ putting food on the table

→ keeping the lights on.

It doesn’t mean ordering takeout, getting coffee from the drive-thru, or a dozen streaming services.

“I need $10,000 a month to make things work”

How much are you making now between work & your business?

“ less than 5”

Where’s the rest coming from? Savings? Incurred debt?

“no, we’re making it work”

OK. So you don’t NEED exactly $10k a month … you want it

Big difference.

HUGE

Now, if what’s coming in is exactly what’s going out

It doesn’t matter if it’s $5,000 or $10,000 or even $100,000

You have to have a good understanding of where your money is going

So you can save for that “rainy day” or slow month

& invest in that “freedom & flexibility” you’re dreaming of

Right now, for me, I’m incurring debt.

Not because I don’t understand money.

But because I understand timelines.

I’m leveraging the equity in the house to help cover the costs on the property … short term

Once the property is “livable” I can sell the house & pay off the debt.

& future bonus points for not having utility bills (except for the odd propane tank refill that’s a backup to solar a few weeks a year)

START “sweating the small stuff”

You’re going to find the most money in the little things that add up over time.

I had a client once who discovered she was spending more money on her takeout than she was her rent!

“but it’s just a few dollars”

That’s the “Latte Factor” … all those little incidentals that add up over time

Our businesses die from “latte factor” spending too.

$10 books.

$100 programs.

$29 subscriptions.

On its own, nothing feels dangerous.

“it’s an investment … & a tax write-off!”

If it’s not earning you a return, it isn’t an investment.

It’s an expense.

When you’re stuck in a learning loop,

The illusion is that you’re investing in the business

If you’re paying for programs you’re not learning from & applying to your business & sharing that knowledge … it’s an expense.

& it’s quietly costing you more than you think.

If this stirred something uncomfortable, you’re not alone.

Because most of us don’t need more money.

Just better clarity.

& fewer surprises.

When you’re up for it, reply & tell me:

Do you actually know what your minimum monthly survival number is?

maybe even …

What’s one money habit you know isn’t helping … but you’ve avoided looking at?

No judgment.

I’ll read & respond to every reply.

Make it a great week!

EG

PS:

If this newsletter helps you think differently, grow more honestly, or feel a little less alone building your business … there are a few ways you can support it (& keep it free for everyone).

→ clicking the 2 ads

Clicking the ads you see helps fund the newsletter with just 10 seconds of your time.

Bonus points (to you) for getting a chance to study their structure … because I DO check every single 1 before approving them.

→ keeping it reader-supported (by choice, not guilt or force)

If this newsletter earns a spot in your week, you can chip in whatever feels right …

bus change, a coffee, or “wow this really helped” $.

No pressure. Ever.

→ Introducing your people to me

If this feels like something your biz friends would find helpful, I’d appreciate you sharing.

& as a thank you, you get a 1-on-1 coaching call from every 10 referrals.

→ Getting a 2nd set of eyes on your business

When you’re ready for 1-on-1 help in your business, schedule a call with your special subscriber rate

AI-native CRM

“When I first opened Attio, I instantly got the feeling this was the next generation of CRM.”

— Margaret Shen, Head of GTM at Modal

Attio is the AI-native CRM for modern teams. With automatic enrichment, call intelligence, AI agents, flexible workflows and more, Attio works for any business and only takes minutes to set up.

Join industry leaders like Granola, Taskrabbit, Flatfile and more.

PPS:

Every email is based on what you ask for … the more something’s asked for, the faster it finds its way to the top of the to-write-about pile

📣 Tell me what you want to read about … here

🔗 Connect with me on LinkedIn … here

📈 Want to talk about better marketing results for your business by being yourself?

Find a time that fits your schedule.